4QFY2019 Result Update | Finance

June 04, 2019

Aditya Birla Capital

BUY

CMP

`102.5

Performance Highlights

Target Price

`130

Particulars (` cr)

4QFY19

3QFY19

% chg (qoq) 4QFY18

% chg (yoy)

Investment Period

12 Months

PBT

4090

3380

21.0

2570

59

PAT

259

206

25.7

170

52

Source: Company, Angel Research

Stock Info

Aditya Birla Capital (ABCL), a financial services provider, continued its robust growth

Sector

Finance

Market Cap (` cr)

21,772

in business operation in 4QFY19 as well. The company’s consolidated PBT

Beta

1.2

increased by 59% yoy and PAT jumped by 52% yoy to `259cr for Q4FY19. Growth

52 Week High / Low

152/76

was supported by lending & AMC business, while health insurance continued to

Avg. Daily Volume

2,38,552

report loss; however management expects it to breakeven in next 2-3 years.

Face Value (`)

10

BSE Sensex

39,714

Coherent strategies for each segment propels overall growth

Nifty

11,922

The company’s operations are divided in 8 segments. Of these, major income

Reuters Code

ADTB.NS

generation comes NBFC, Asset Management, Life insurance and housing finance.

Bloomberg Code

ABCAP.IN

NBFC: The segment includes retail, SME and UHNI lending, constituting 53% of the

loan mix; loan book increased by 20% yoy to `51,714cr in this segment. GNPA

Shareholding Pattern (%)

and NPA were maintained at 1.05% and 0.55% respectively. In tough liquidity

scenario, ABCL was able to reduce COF and high share of yield asset helped NIM

Promoters

72.8

at 5.2%.

MF / Banks / Indian Fls

7.0

Asset Management: AUM for FY2019 increased moderately 6% and equity mix in

FII / NRIs / OCBs

3.6

the AUM went up 400bps to 36%. On profitability front, it reported highest ever

Indian Public / Others

16.6

PBT/AUM of 29bps for Q4FY2019.

Insurance: Reported healthy APE growth of 41% yoy in 4QFY2019 largely owing to

HDFC Bank branch network. EV grew 14% yoy to `4,900cr and VNB margin

improved 520bps yoy to 9.5% primarily owing to (1) HDFC Bank partnership, (2)

Abs. (%)

3m 1yr

3yr

improvement in persistence in every bucket (13th mth, 25th mth and 37th mth), and

Sensex

9.0

12.4

54.1

(3) increase in share of retail protection business.

ABCL

(0.8)

(32.5)

-

Housing finance: Advances grew at

40% yoy led by affordable housing in

4QFY2019 taking the book to `11,405cr. Despite aggressive growth, asset quality

Price chart

remained steady (stage 3 - 0.67% and Net stage 3 - 0.37%). NIM remained under

300

pressure at 3.1% due to increase in cost of funds and increased competition from

250

200

banks. Cost-to-income declined from 64% in Q4FY2018 to 47% in Q4FY2019.

150

Outlook & Valuation: We believe broad based and integrated financial offerings will

100

50

enable ABCL to benefit from financialisation of savings. We expect ABCL’s PAT to

0

register CAGR of 42% over FY2019-21E, largely driven by lending segment and

AMC. We recommend a Buy on the stock with a target price of `130.

Key Financials

Source: Company, Angel Research

Y/E March (` cr)

FY19

FY20E

FY21E

PBT

1,796

2,368

3,032

% chg

25

32

28

PAT

871

1,281

1,699

% chg

2

47

33

EPS

4

6

8

Jaikishan Parmar

ROE

9

12

14

Research Analyst

P/B

2.3

2.0

1.8

022 - 39357600 Ext: 6810

P/E

25

17

13

Source: Company, Angel Research; Note: CMP as of June 03, 2019

Please refer to important disclosures at the end of this report

1

Aditya Birla Capital Ltd | Q4FY2019 Result Update

Outlook & Valuation:

We believe broad based and integrated financial offerings will enable ABCL to

benefit from finacialisation of savings. Core lending business (after adjusting

value of AMC, Life Insurance, ABML & Others) is available at 1.1x of FY20E

BV. We expect ABCL’s PAT to register CAGR of 42% over FY2019-21E, largely

driven by lending segment and AMC. We recommend a Buy on the stock and

an SOTP based Target Price of `130.

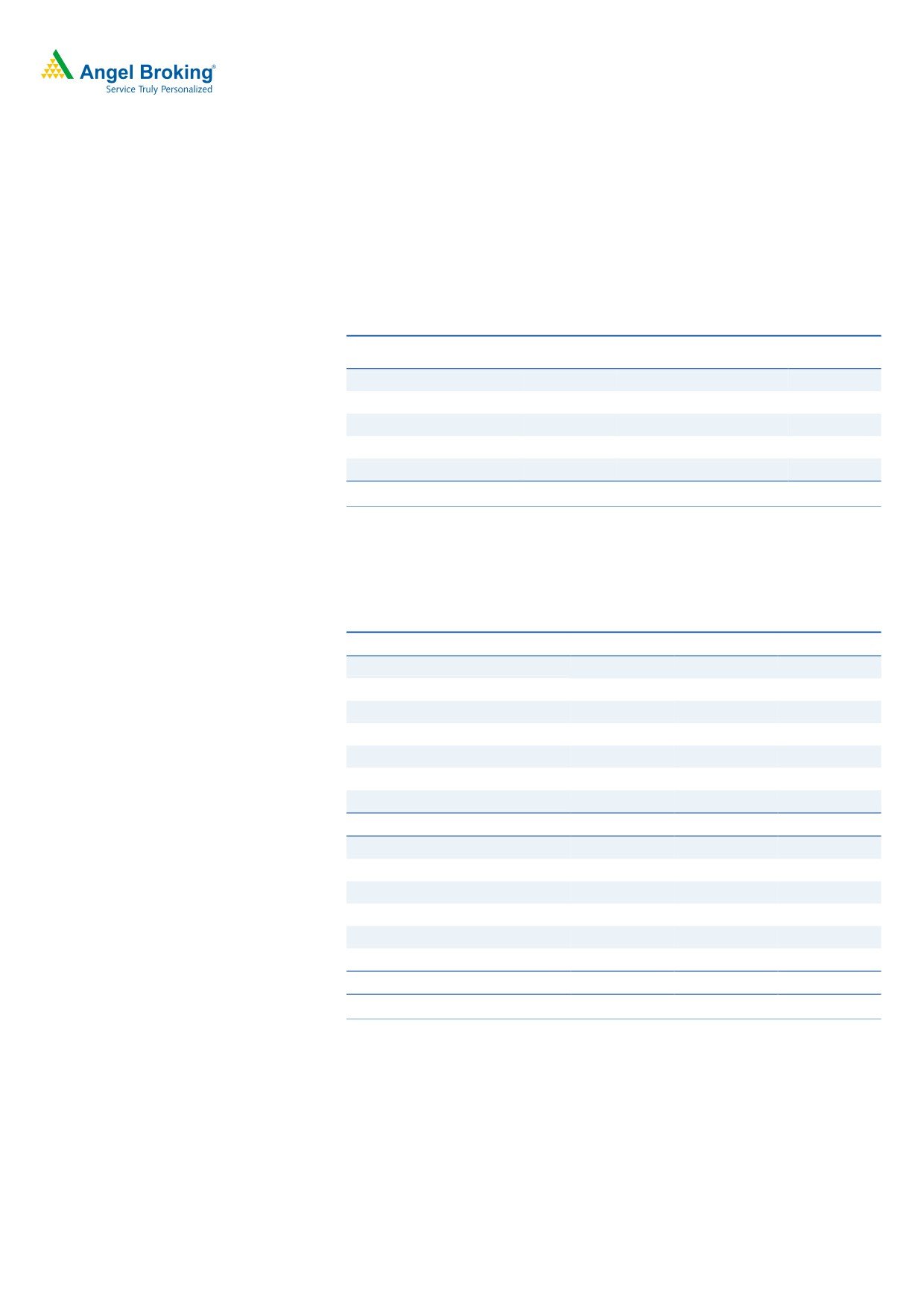

Exhibit 1: SOTP valuation summary

Valuation

Particulars

Stake

Value/share (`)

Methodology

NBFC

100%

1.7x FY20E PBV

75

HFC

100%

1.7x FY20E PBV

12

AMC

51%

4% of AUM

23

Life Insurance

51%

1.75x FY18 EV

20

ABML

74%

CMP

1

Fair value per share

130

Consolidated Profit & Loss

Y/E March (` cr)

FY19

FY20E

FY21E

Segment PBT

NBFC

1,328

1,602

1,948

Life Insurance

132

144

159

Asset Management

647

673

811

HFC

107

152

213

Health Insurance

-257

-100

-

Total PBT

1,796

2,368

3,032

YoY

25

32

28

Consolidated PBT

1,796

2,368

3,032

Taxes

569

758

1,001

Tax Rate (%)

32

32

33

Consolidated PAT

1,227

1,610

2,032

Minority Interest

356

329

333

Consolidated PAT Post MI

871

1,281

1,699

2

47

33

June 03, 2019

2

Aditya Birla Capital Ltd | Q4FY2019 Result Update

Research Team Tel: 022 - 39357800

DISCLAIMER

Angel Broking Private Limited (hereinafter referred to as “Angel”) is a registered Member of National Stock Exchange of India Limited,

Bombay Stock Exchange Limited and Metropolitan Stock Exchange Limited. It is also registered as a Depository Participant with CDSL

and Portfolio Manager and Investment Adviser with SEBI. It also has registration with AMFI as a Mutual Fund Distributor. Angel Broking

Private Limited is a registered entity with SEBI for Research Analyst in terms of SEBI (Research Analyst) Regulations, 2014 vide

registration number INH000000164. Angel or its associates has not been debarred/ suspended by SEBI or any other regulatory

authority for accessing /dealing in securities Market. Angel or its associates/analyst has not received any compensation / managed or

co-managed public offering of securities of the company covered by Analyst during the past twelve months.

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should

make such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the

companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine

the merits and risks of such an investment.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals. Investors are advised to refer the Fundamental and Technical Research Reports available on our website to evaluate the

contrary view, if any

The information in this document has been printed on the basis of publicly available information, internal data and other reliable

sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this

document is for general guidance only. Angel Broking Pvt. Limited or any of its affiliates/ group companies shall not be in any way

responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report.

Angel Broking Pvt. Limited has not independently verified all the information contained within this document. Accordingly, we cannot

testify, nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document.

While Angel Broking Pvt. Limited endeavors to update on a reasonable basis the information discussed in this material, there may be

regulatory, compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.

Neither Angel Broking Pvt. Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from

or in connection with the use of this information.

Disclosure of Interest Statement

Aditya Birla Capital Ltd

1. Analyst ownership of the stock

No

2. Angel and its Group companies ownership of the stock

No

3. Angel and its Group companies' Directors ownership of the stock

No

4. Broking relationship with company covered

No

Ratings (Based on expected returns

Buy (> 15%)

Accumulate (5% to 15%)

Neutral (-5 to 5%)

over 12 months investment period):

Reduce (-5% to -15%)

Sell (< -15)

Note: We have not considered any Exposure below ` 1 lakh for Angel, its Group companies and Directors

June 03, 2019

3